Navigating the Complex Globe of Insurance: A Comprehensive Overview

Navigating the Complex Globe of Insurance: A Comprehensive Overview

Blog Article

Exactly How Pet Dog Insurance Coverage Can Aid You Reduce Veterinary Expenses

Family pet insurance coverage acts as a critical economic tool for animal owners, resolving the unpredictable nature of vet expenses. By giving insurance coverage for both accidents and illnesses, these plans can considerably reduce the prices related to necessary clinical therapies. This not only fosters a complacency for proprietors however also advertises proactive wellness management for their animals. However, understanding the nuances of various plans and the prospective lasting financial savings needs mindful factor to consider. What variables should animal owners focus on when examining their alternatives?

Comprehending Pet Dog Insurance Coverage Essentials

Exactly how can animal insurance alleviate the financial problem of unexpected vet costs? Animal insurance acts as a monetary safeguard for pet dog owners, supplying satisfaction when confronted with unexpected clinical costs. By covering a considerable portion of vet bills, family pet insurance coverage can help reduce the stress that occurs from emergencies, persistent ailments, or mishaps that require immediate attention.

Comprehending the essentials of animal insurance entails recognizing its core parts, including costs, deductibles, and compensation rates. Premiums are the monthly or annual payments required to keep insurance coverage. Deductibles, on the various other hand, are the out-of-pocket costs that pet owners have to pay before the insurance plan begins to give coverage. In addition, reimbursement prices identify the percentage of eligible expenses that the insurer will certainly cover after the insurance deductible is fulfilled.

Being notified about these elements makes it possible for animal owners to make sound decisions when selecting a plan that lines up with their monetary circumstances and their pets' wellness requirements. Eventually, understanding the fundamentals of family pet insurance can encourage family pet proprietors to protect their fuzzy companions while effectively managing vet expenditures.

Kinds of Pet Insurance Policy Plans

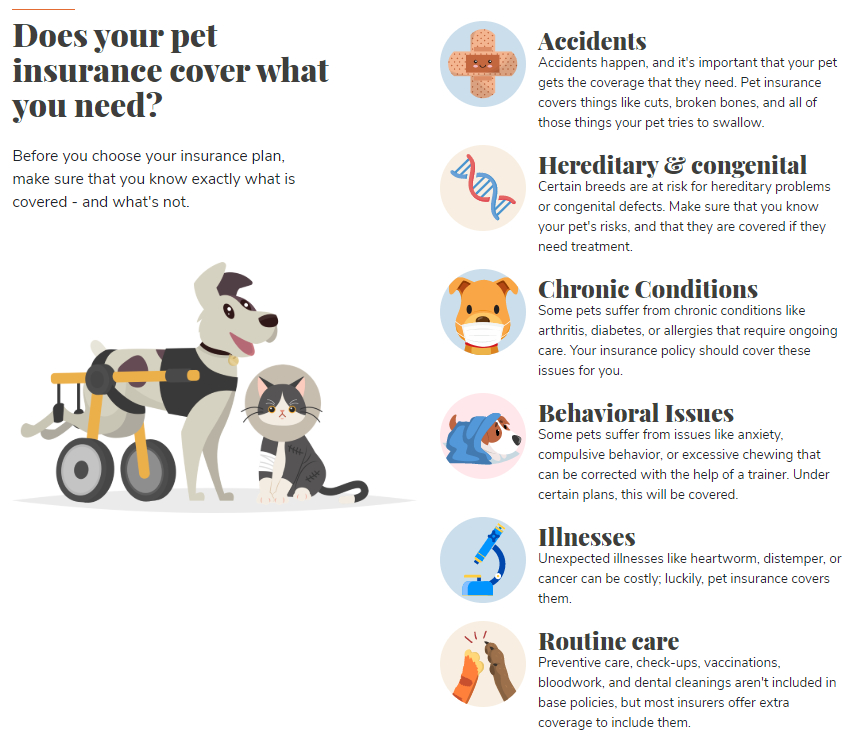

Pet dog insurance coverage plans come in different kinds, each developed to satisfy the diverse needs of animal owners and their family pets. The most common kinds include accident-only policies, which cover injuries resulting from accidents but exclude ailments. These strategies are frequently extra budget-friendly, making them appealing for those seeking fundamental coverage.

Detailed strategies, on the other hand, offer a broader range of insurance coverage by encompassing both diseases and crashes. This sort of plan generally consists of arrangements for numerous vet services, such as diagnostics, surgeries, and prescription medicines, therefore providing even more comprehensive financial security.

Another option is a wellness or precautionary care strategy, which concentrates on regular wellness maintenance (Insurance). These plans usually cover vaccinations, yearly examinations, and dental cleanings, aiding pet dog owners in taking care of preventative treatment expenditures

Lastly, there are adjustable strategies that allow family pet owners to tailor protection to their details demands, enabling them to pick deductibles, reimbursement rates, and fringe benefits. Recognizing these different types of pet dog insurance coverage plans permits family pet proprietors to make informed decisions, ensuring they pick the very best suitable for their cherished buddies.

Expense Comparison of Veterinary Treatment

When examining the monetary aspects of pet ownership, an expense contrast of veterinary care ends up being important for accountable animal guardians. Vet expenditures can vary dramatically based on the kind of treatment needed, the place of the veterinary facility, and the particular requirements of the pet. Routine solutions such as inoculations and yearly examinations often tend to be less pricey, generally ranging from $100 to $300 each year. Unpredicted clinical problems can intensify expenses substantially, with emergency situation treatments potentially getting to a number of thousand dollars.

For circumstances, treatment for usual conditions like ear infections might set you back between $200 and $400, while more significant conditions, such as diabetes or cancer cells, could lead to expenditures going beyond $5,000 gradually. In addition, analysis procedures, including X-rays and blood tests, better add to the general expense problem.

Comparing veterinary costs across various facilities and comprehending the sorts of solutions supplied can assist pet dog proprietors make notified decisions. This contrast not just help in budgeting for expected expenses but also prepares guardians for possible emergency circumstances, underscoring the relevance of financial preparation in pet possession.

How Insurance Policy Decreases Financial Stress And Anxiety

Browsing the intricacies of veterinary expenditures can be overwhelming for pet dog proprietors, specifically when unanticipated health concerns occur. The economic burden of emergency treatments, surgical treatments, or chronic problem click to read more administration can rapidly rise, leading to significant stress and anxiety for family members currently encountering the psychological toll of their family pet's ailment. Pet insurance acts as a useful financial safety net, allowing pet proprietors to focus on their family pet's well-being as opposed to the placing prices of care.

Along with securing versus big, unforeseen prices, pet insurance policy can urge regular veterinary treatment. Family pet proprietors are more probable to seek normal examinations and precautionary therapies, understanding that these prices are partially covered. This proactive approach can more information lead to better wellness end results for animals, inevitably enhancing the bond between family pet and proprietor while relieving financial stress.

Maximizing Your Plan

Maximizing the advantages of your pet insurance coverage calls for a positive and educated technique. Begin by thoroughly recognizing your policy's terms, including coverage restrictions, exemptions, and the insurance claims process. Acquaint on your own with the waiting periods for specific conditions, as this expertise can aid you navigate potential insurance claims successfully.

Next, keep detailed records of your family pet's case history, including vaccinations, therapies, and any kind of pre-existing problems. When unforeseen veterinary expenses emerge., this documentation can facilitate smoother cases and make sure that you obtain the protection you're entitled to.

Regularly review your policy to ensure it straightens with your family pet's advancing health needs. Insurance. As your animal ages or if they develop chronic conditions, take into consideration changing your coverage to offer sufficient defense against rising costs

Last but not least, connect freely with your veterinarian regarding your insurance coverage strategy. They can aid you recognize which treatments are covered and guide you in making educated choices for your animal's useful site health and wellness, inevitably boosting the value of your insurance coverage policy.

Verdict

In final thought, animal insurance policy offers as a useful economic device for pet dog owners, properly mitigating the expenses associated with veterinary treatment. By offering protection for both crashes and ailments, these policies assist in access to needed treatments without the problem of high expenditures. The promo of regular exams and preventative treatment not just supports overall pet dog health yet also leads to long-term economic cost savings. Eventually, pet dog insurance represents a proactive method to accountable animal ownership.

Animal insurance coverage offers as a strategic financial device for family pet proprietors, addressing the unforeseeable nature of vet costs. Family pet insurance coverage serves as a financial safety web for family pet owners, providing peace of mind when encountered with unforeseen clinical costs.Animal insurance policy intends come in different types, each developed to meet the varied demands of animal owners and their animals. Pet insurance policy serves as a beneficial economic security web, enabling pet proprietors to concentrate on their animal's well-being instead than the mounting costs of care.

In verdict, pet insurance serves as a useful financial tool for pet dog owners, successfully alleviating the prices linked with vet care.

Report this page